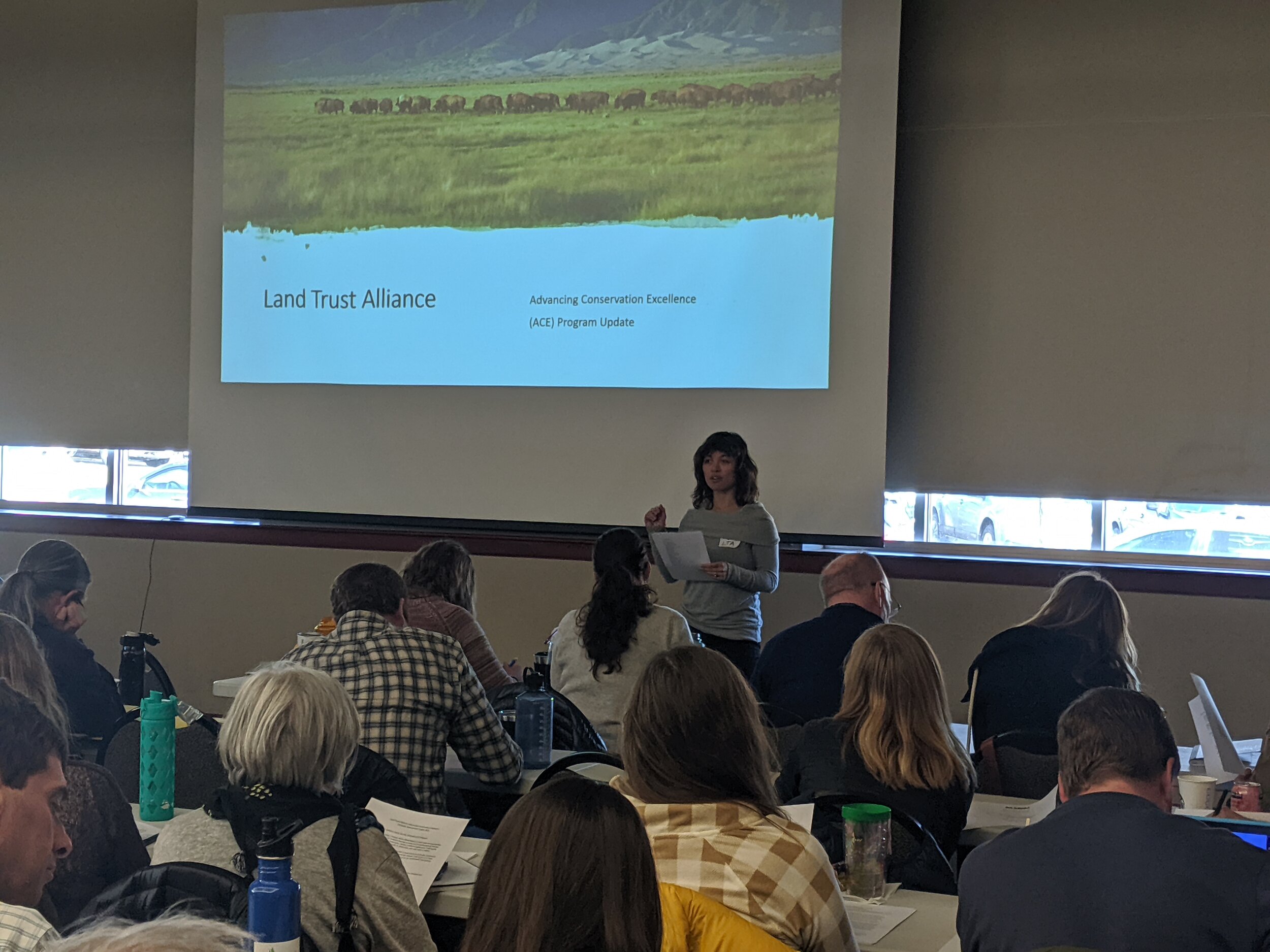

We had an impressive turnout at our Fall Policy Summit on November 7. Many thanks to those of you who traveled across the state to join us! Held at the American Mountaineering Center in Golden, our event attracted around 70 members of our community – including land trusts, conservation professionals and public or open space agencies actively engaged in policy around private land conservation. We hope you all felt the conversation was as informative and productive as we did.

Our main goal was to inform attendees about several policy proposals that have been drafted for legislative consideration in 2020 (review the proposal highlights here and download our PowerPoint presentation). We also had a great discussion. To read a recap of what was discussed, jump below to the Summit Recap: What You Should Know.

Additionally on November 12, the HB19-1264 Working Group met to discuss the proposals as they currently stand and to make its recommendations. Download a summary of the HB19-1264 Working Group’s draft recommendations. On Monday, November 18 the working group held a final meeting to further fine-tune the recommendations before submitting them to the legislature for consideration.

We also invited the community to take a survey to share additional thoughts and feedback; the input will help Keep It Colorado finalize our policy platform.

What’s next?

Based on community input and on the outcomes from the HB19-1264 Working Group meeting, we’ll adjust the policy proposals and take the revised package to Keep It Colorado’s policy committee.

The policy committee will make its final recommendations to our board of directors, which will then adopt the 2020 policy platform.

Keep It Colorado will use that platform to advance our community’s interests in the 2020 legislative session.

Thank you again for being part of this process. Your voice and participation are critical to helping Keep It Colorado achieve our vision of a Colorado where people, lands, waters and wildlife thrive.

Policy Summit Recap: What You Should Know

Below are the top five things you should know and a few outstanding questions about each proposal. If you have any additional or unanswered questions, please let us know.

1. Expanding Taxpayers to Include Water Entities

(Download the proposal)

Top 5 Things to Know:

It expands the definition of qualifying entities that can receive a tax credit to water entities, which can include local governments but not state or federal governments.

Tax exempt entities benefit from the sale of the credits.

It may incentivize more conservation easements, and therefore permanent protection, for land surrounding water that could otherwise be developed.

Initial response from the water community was supportive.

The other proposal related to expanding the definition of donor from “taxpayer” to “landowner” helps address similar challenges this proposal addresses, but some additional integration of the two proposals would be needed.

Outstanding Questions:

Could we / should we clarify what types of organizations qualify as “water entities”?

Could we add a clause noting that if the water entity condemns the property in the future (resulting in the termination of the easement), it will be required to repay the credit?

2. Proposed Technical Changes to Conservation Easement Tax Credits

(Download the proposal)

Top 5 Things to Know:

This proposal contains four key elements that could be considered separate policy positions.

These elements all help to tighten the conservation tax credit statutes to better align with the other tax credits in the state.

One proposal changes the definition of donor from “taxpayer” to “landowner,” which would help out-of-state landowners donating easements; this proposal could be integrated into the water entity proposal if desired.

One proposal creates a tracking system with the Division of Conservation, which would allow buyers and sellers of credits to file their taxes and use their credits on their own timeline. It would also create a better system for tracking credits without putting the onus on the Department of Revenue.

One proposal allows landowners to claim a $50,000 refund in years of a TABOR surplus, even if they are also selling their credits.

HB19-1264 Working Group Recommendations

Note: On November 12, 2019, the HB19-1264 Working Group met to finalize a set of legislative recommendations for Aggrieved Landowner Payments, Orphaned Easement Administration and Alternative Valuation. Additional discussion is needed before final recommendations can be submitted, so the working group will convene again on Monday, November 18. We welcome our members' feedback on the current draft recommendations and will continue to provide updates as they are available. Download a summary of the HB19-1264 Working Group’s draft recommendations.

For more information about the working group, visit our website.

3. Aggrieved Landowner Payments

Top 5 Things to Know:

Landowners and tax credit buyers whose credits were disallowed between 2000 and 2013 could receive a payment in the form of a refund or credit.

The conservation easement must have been conveyed in good faith and the value of the credits must be substantiated by a federal deduction.

The timeframe to apply for a refund or credit is three years.

The estimated cost to refund or reinstate credits is approximately $147 million. The recommendation also includes adding interest, which cannot be estimated. Funding comes from unused tax credit caps in previous years or, if needed, up to half of the credit cap for future years.

The working group members recognize that these initial recommendations may be negotiated during the legislative session.

4. Orphaned Easement Administration

Top 5 Things to Know:

The proposal is geared toward entities that have fully abandoned their easements; it is not intended as a review of individual easements for placement in the program. Individual easements will be evaluated once in the program, and appropriately reassigned or amended.

The Division of Conservation is a holding entity for the easements while they are evaluated by the Conservation Easement Oversight Commission (CEOC). The evaluation places each easement into one of three categories: 1) Ready to be reassigned immediately; 2) Could be reassigned with amendments; 3) Cannot be reformed to be reassigned. Easements in the third category are referred to the Attorney General’s office for termination proceedings.

While at the Division of Conservation, easements are monitored by accredited land trusts on a voluntary basis. Funding for the monitoring comes from a Stewardship Fund established under this program. The Division assumes enforcement responsibilities.

The CEOC determines reassignment of the easements to interested and willing accredited land trusts. The program attempts to reassign easements within five years of being placed with the Division of Conservation. The Division has one year to review the easements once they’ve been deemed “abandoned,” and then four years to amend and reassign them.

Administrative costs for the program are estimated at or under $1 million. The proposal recommends issuing the first $1.1 million of tax credits under the annual cap to the Division to offset program costs.

Outstanding Questions:

Is the timeline for the reassignment of the nearly 300 easements too aggressive and therefore not realistic?

Could we use part of the tax credit each year to fund this program since the Division of Conservation is a fee-based agency with very little staff and resources?

The proposal mentions that the Division or counties could be receivers. How do the counties feel about that?

5. Alternative Valuation

Top 5 Things to Know:

An alternative valuation method does not replace the current conservation easement program – it runs parallel to it, giving landowners greater options and hopefully results in more conservation.

The proposal includes an increase of the tax credit percentage to “up to 90%,” which allows landowners to receive a higher value for their easement, when appropriate, for their individual situation.

A pilot program has not been finalized. The updated proposal recommends continuing conversations and planning for the pilot program and its implementation. Keep It Colorado will convene those meetings.

The continued conversations will focus on four key topics: 1) The draft pilot program proposal the issue team had been discussing; 2) Recommendations from the Colorado State University study on alternative methodologies that concluded this fall; 3) Options for term conservation products that may be considered in the future; and 4) Future decoupling from Section 170(h) of the Internal Revenue Code.

When ready, the pilot program would exist for one to two years and be funded by private funders – in other words, no public money (or tax credits) would initially be committed.

Outstanding Questions:

Is the increase of “up to 90%” going to mean fewer conservation deals can be completed under the cap, and will landowners appear greedy in the eyes of legislators and/or the public?